Key Highlights

- Easily check your PAN card status through official websites

- Keeping your PAN card active is essential for financial and tax transactions

- Follow steps to reactivate your PAN card if it’s inactive

An active PAN card is essential for financial transactions and tax purposes in India. Sometimes, PAN cards can become inactive without the cardholder’s knowledge, leading to complications. This article will guide you through the simple steps to check if your PAN card is active or inactive. We’ll cover the importance of keeping your PAN card active, the methods to verify its status online, and what to do if you find that your PAN card is inactive. By following these easy instructions, you can ensure that your PAN card remains in good standing, avoiding any potential issues with financial and tax-related activities.

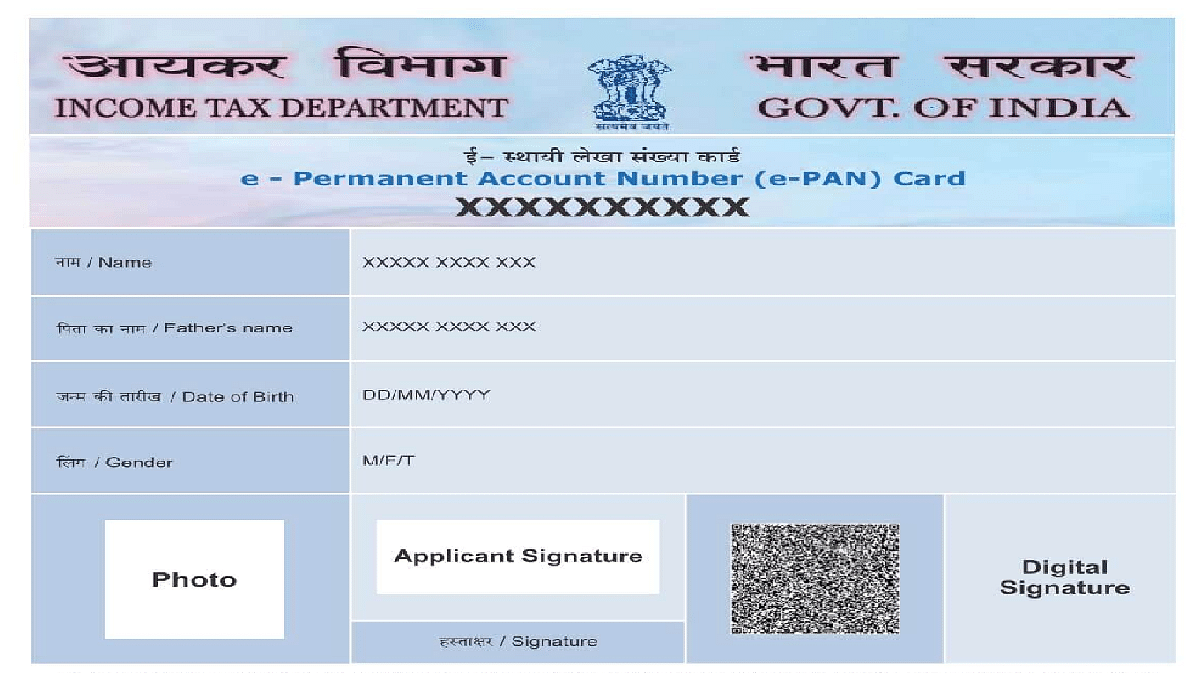

Also Read | Need To Download Your e-PAN Card Online? Here’s A Step-by-Step Guide

Prerequisites

Before you start, make sure you have:

- Your PAN number (found on the front of your PAN card)

- A valid and registered mobile number

Steps To Check PAN Card Status

The government provides an online facility to check the status of your PAN card through the Income Tax portal. Follow these steps:

Step 1: Start by visiting the official Income Tax e-filing website.

Step 2: On the left side of the homepage, you will see a Quick Links tab. Look for the ‘Verify PAN Status’ option and click on it.

Step 3: You will be prompted to enter your PAN card number, Date of Birth, Full Name, and Mobile number. Be sure to enter these details correctly.

Step 4: After entering all the required details, click on the ‘Continue’ button.

Step 5: You will receive an OTP (One Time Password) on your registered mobile number. Enter this OTP to complete the verification.

Step 6: Once verified, your PAN card status will be shown on the screen.

Also Read | Lost PAN Card? Here’s How To Apply For A Duplicate PAN Card Online

What To Do If Your PAN Card Is Inactive

If the status shows that your PAN card is active, you have nothing to worry about. However, if your PAN card is inactive, you will need to take steps to reactivate it. To do this, you must draft a PAN Reactivation letter and send it to the Jurisdictional Assessing Officer (AO) at the Income Tax Department.

Maintaining an active PAN card is vital for smooth financial transactions and compliance with tax regulations. By following these simple steps, you can easily check the status of your PAN card and ensure it is always active.

For the tech geeks, stay updated with the latest cutting-edge gadgets in the market, exclusive tech updates, gadget reviews, and more right on your phone’s screen. Join Giznext’s WhatsApp channel and receive the industry-first tech updates.