Key Highlights

- Adhaar and Pan link deadline exhausted on 31 May 2024

- Linking essential of tax payers

- Fines being charged for delayed PAN and adhaar card linking

Indian government made it mandatory for the Indian citizens to link their Adhaar card. The deadline earlier was set for June 30, 2023 failing to which leads to deactivation of PAN card an services. Thankfully, Income tax department provided a respite to the eligible tax payers by further extended the deadline till May 31, 2024. For the defaulters, a penalty is being charged by the Income tax department which can still be avoided if the linking is done online. If you have missed out on linking your Adhaar and PAN card then we are making it easier for you by listing the steps.

For the tech geeks, stay updated with the latest cutting-edge gadgets in the market, exclusive tech updates, gadget reviews, and more right on your phone’s screen. Join Giznext’s WhatsApp channel and receive the industry-first tech updates.

Also Read: WhatsApp Rolls Out ‘Favorites’ Filter: What It Is And How To Use

Adhaar And PAN Link: Late Fees

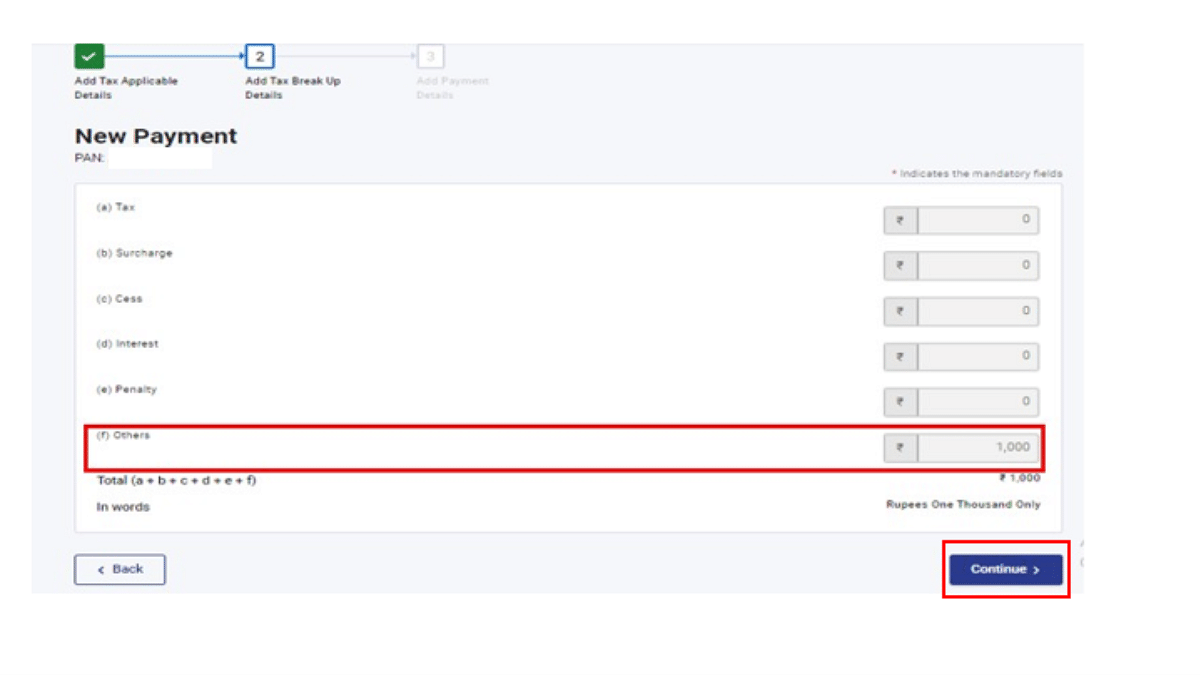

If you have somehow missed all the deadlines for linking your PAN and adhaar card, you still can get the process rolling. Visiting Income tax’s official website, you can complete the Adhaar and PAN linking after paying a penalty of Rs. 1,000. This late fee is mandate to be paid before proceeding with the steps to link Adhaar and PAN online.

Also Read: Google Maps Quick Hacks: How To Enable Google Maps 3D View On Desktop

Steps To Link Adhaar And PAN Card Online

Step 1: Open any web browser on your laptop/ PC and visit Income tax official website.

Step 2: Login to the portal with your credentials. Ensure to register first if you are a new user.

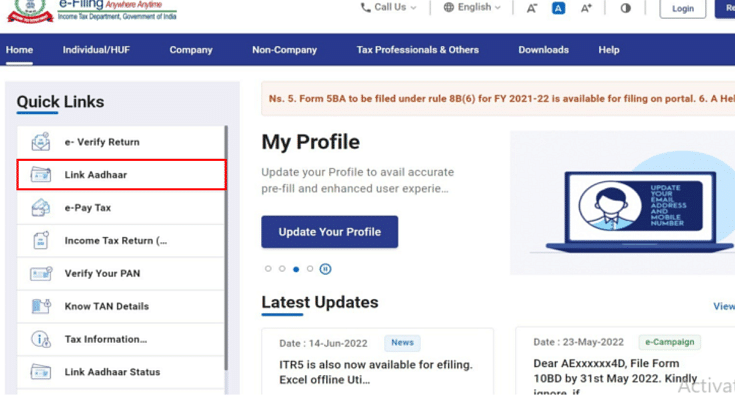

Step 3: Go to the ‘Quick Links‘ section which you can locate on the left.

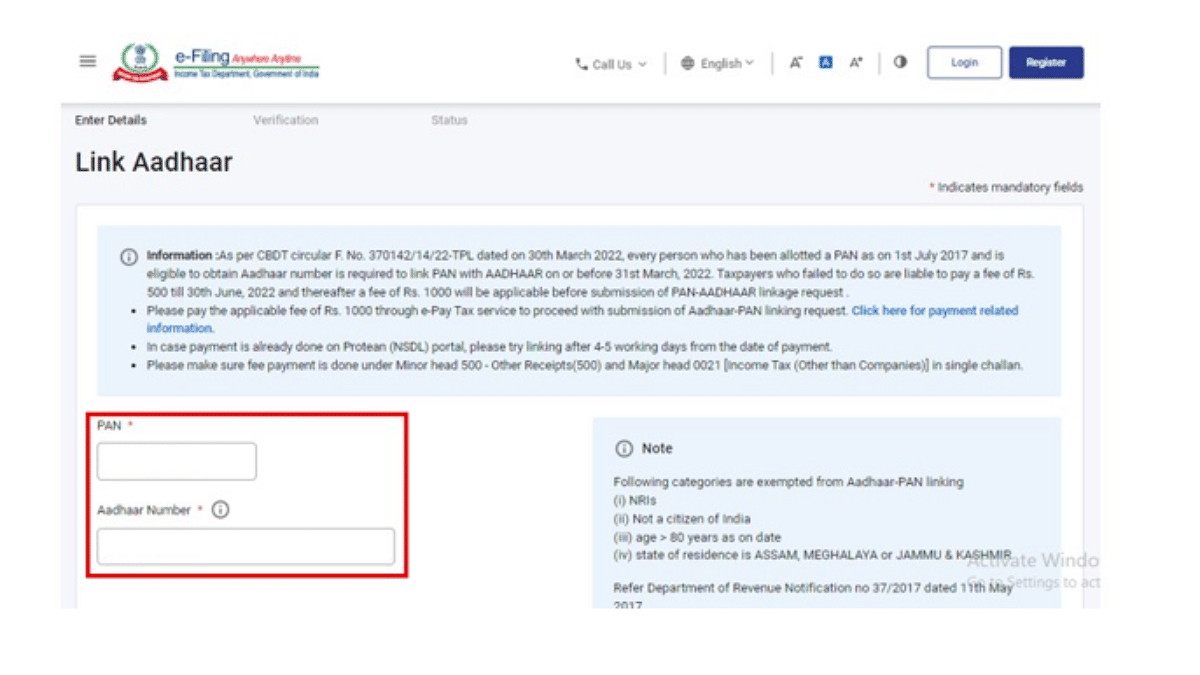

Step 4: Enter both your PAN and Adhaar number.

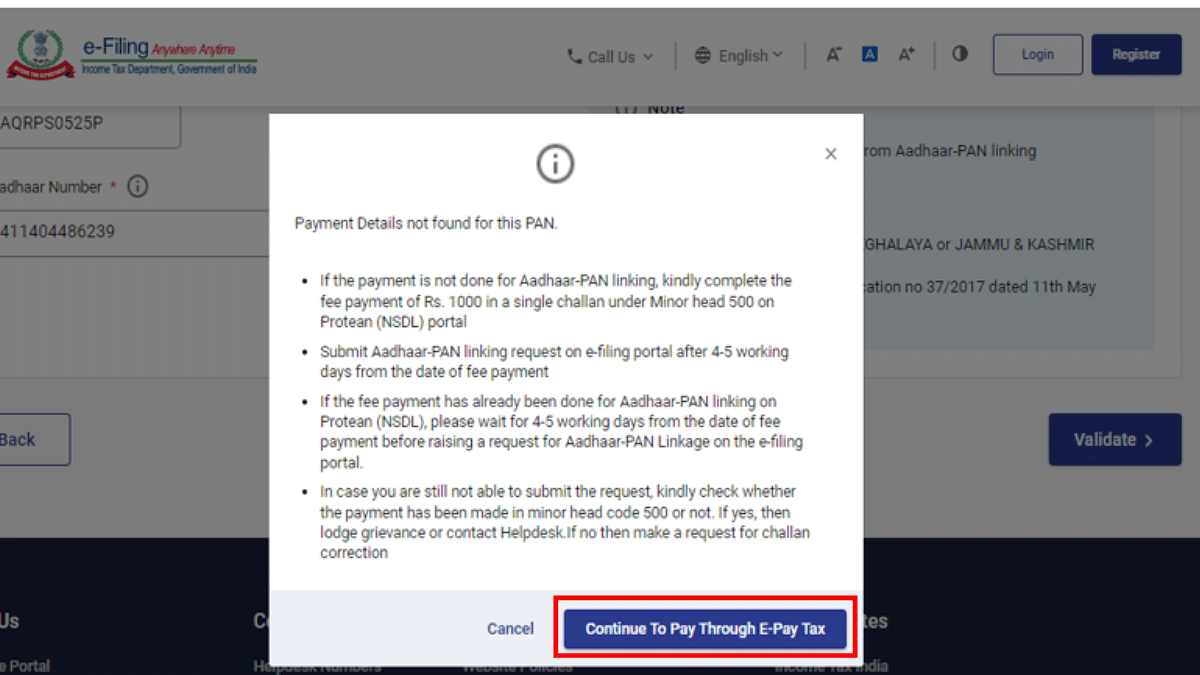

Step 5: A new pop up will show up on the screen from where you need to select ‘Continue To Pay Through E-Pay Tax‘ option.

Step 6: Re-enter and confirm your PAN number and also enter your Adhaar registered mobile number for OTP.

Step 7: After OTP verification a new e-Pay Tax page will open op. Click on continue.

Step 8: You’ll now see a bunch of more options including Income Tax, Equalization Levy, Fee/ Other Payments. Tap the Proceed icon on the Income Tax box.

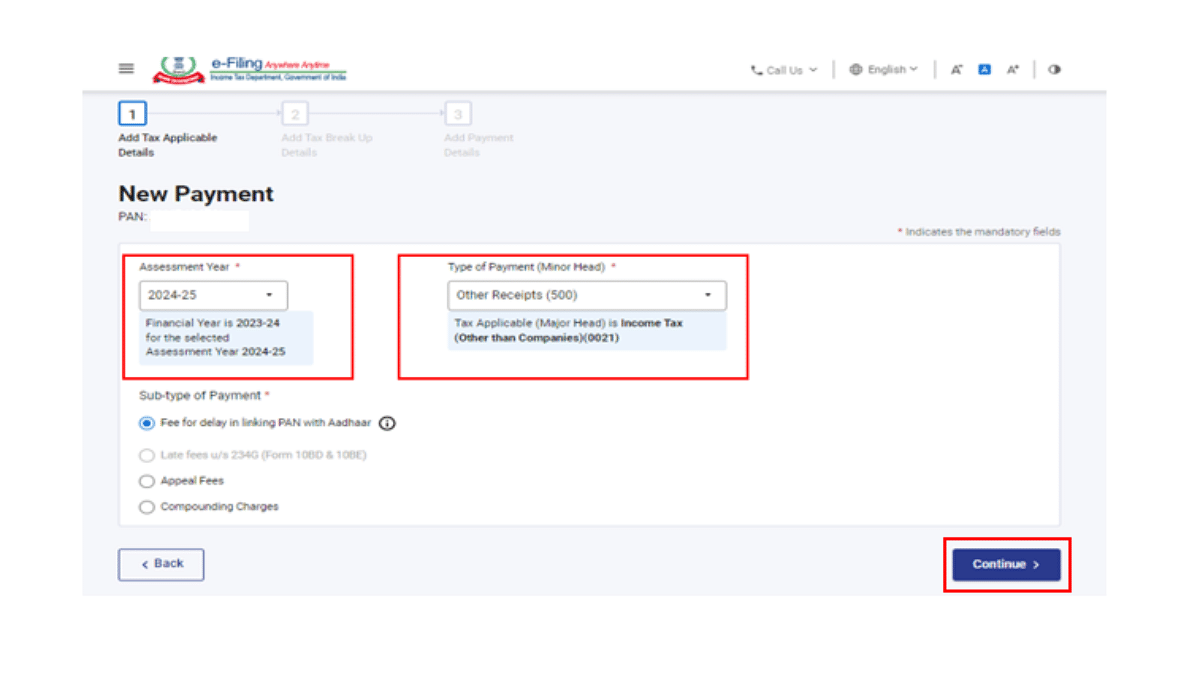

Step 9: Select 24- 25 option in the Assesment Year tab

Step 10: Select Other receipts (500) from the next checkbox and tap on Continue.

Step 11: Once the e-challan is generated, make the payment by selecting the desired mode.

Once these steps are complete and you are done with the late fees payment, you can easily raise the request for activation of Adhaar and Pan Link process.