Key Highlights

- The first UPI-based ATM was launched by NPCI in India

- Without a card, cash can be withdrawn using a UPI ATM

- At the Global Fintech Fest 2023, UPI ATM was on show

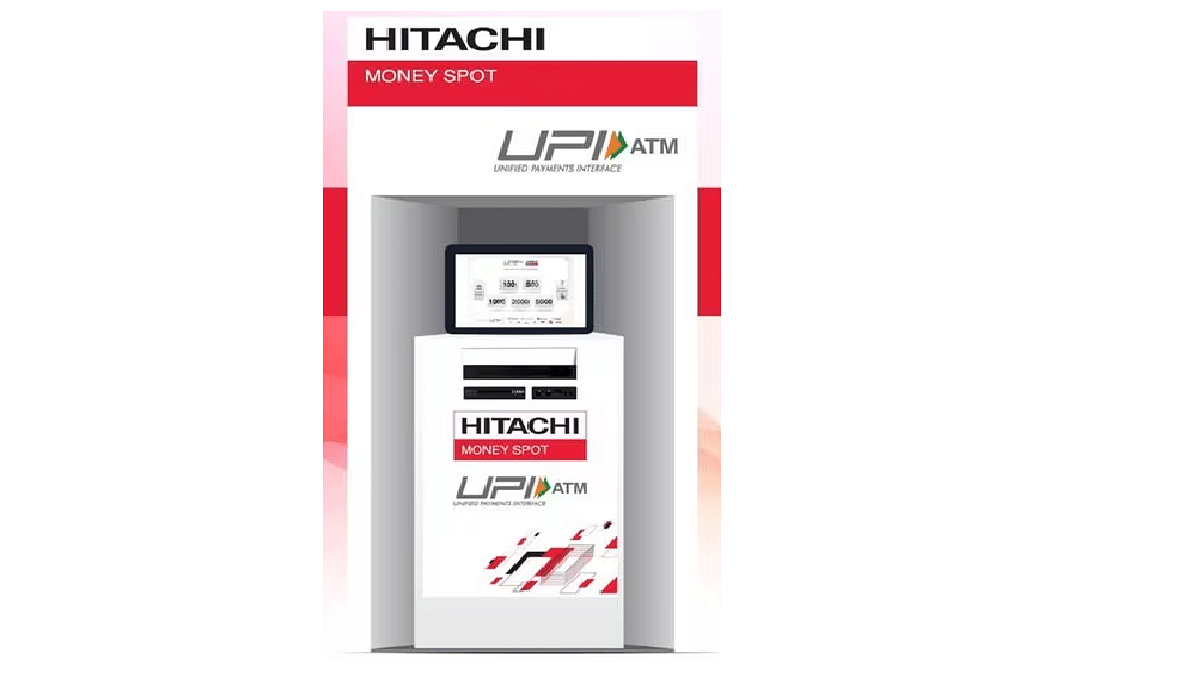

Hitachi Payment Services, a subsidiary of the renowned Japanese conglomerate Hitachi, has introduced a groundbreaking White Label ATM (WLA) in partnership with the National Payments Corporation of India (NPCI). This innovative creation, named the Hitachi Money Spot UPI ATM, redefines the way customers access cash, eliminating the need for traditional debit or credit cards. Also Read | Use UPI On Your Feature Phone With Ease: Here’s How

Unveiled at the Global Fintech Fest 2023 in Mumbai on September 5, 2023, the Hitachi Money Spot UPI ATM marks a pivotal moment in banking convenience. With the expansion of these UPI ATMs to various locations, the days of carrying physical cards to ATMs for cash withdrawals will soon become a thing of the past. This revolutionary concept allows individuals to withdraw cash directly from their bank accounts through UPI apps.

How To Use Hitachi Money Spot UPI ATM

Curious about how this UPI-ATM works? Sumil Vikamsey, Managing Director & CEO – Cash Business at Hitachi Payment Services, simplifies the process:

Step 1: Begin by choosing the desired withdrawal amount from the ATM.

Step 2: A QR code corresponding to your selected amount will appear on the screen.

Step 3: Use any UPI app on your mobile phone to scan the displayed QR code. Then, enter your UPI PIN to authorize the transaction.

Step 4: Once authorized, the ATM will dispense the requested cash.

Who Can Benefit From UPI-ATMs?

The accessibility of UPI-ATMs is not limited to a select few. As Vikamsey explains, “Anyone with a registered UPI application on their Android or iOS device can utilize UPI-ATMs.” Furthermore, these White Label ATMs can be harnessed by Payment Service Providers (PSPs) with the necessary certification for Interoperable Cardless Cash Withdrawal (ICCW) functionality, as well as issuer banks that have adopted this feature.

Vikamsey anticipates that more banks and UPI PSPs will join this transformative initiative in the future. While customers had the opportunity to experience it at the Global Fintech Fest 2023, full-scale deployment will commence in the coming months.

Enhancing Security And Promoting Financial Inclusion

Beyond its convenience, the UPI-ATM also addresses security concerns. It significantly reduces the risk of card skimming by fraudsters. Moreover, it is expected to bolster financial inclusion by providing easy access to banking services in areas where traditional banking infrastructure and card usage are limited—a vision championed by Hitachi Payment Services.

Also Read | UPI Tips And Tricks: Here’s How You Can Set UPI PIN Without Using Debit Card Details