Key Highlights

- Use it for shopping, bills, payments as usual.

- No new deposits, FASTags, NCMC cards after Feb 29th.

- Withdraw funds or switch UPI before Feb 29th.

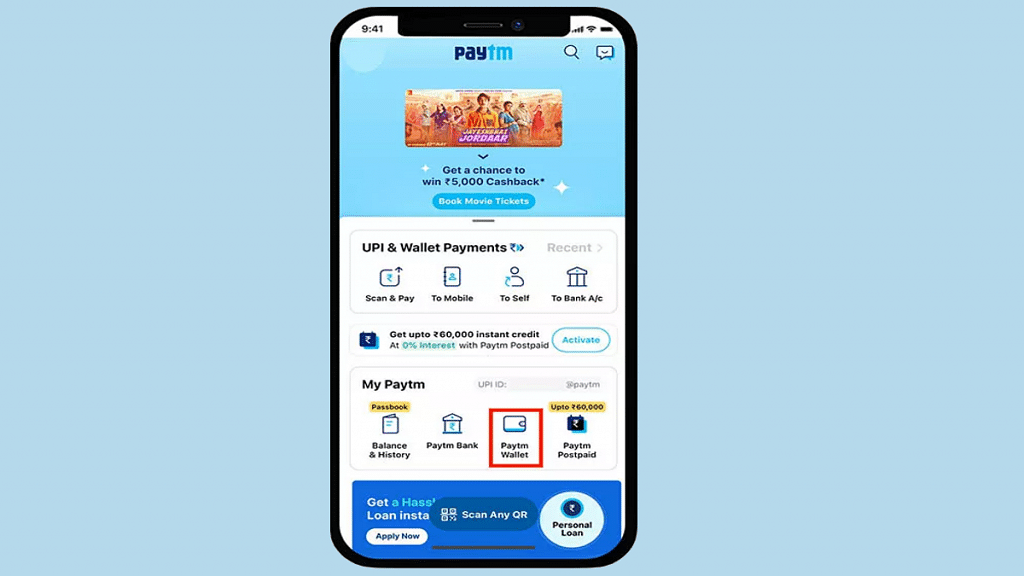

The good news for most Paytm users is that the recent RBI restrictions do not impact the core Paytm app. You can continue to use it for online payments, recharges, bill payments, and other services as usual. However, these restrictions affect Paytm Payments Bank, a separate entity within the Paytm ecosystem.

Also Read: Step Into Safety: Learn How To Change Your UPI PIN On Google Pay And PhonePe

What Does the Ban Mean for Paytm Payments Bank Users?

Starting February 29, 2024, Paytm Payments Bank users will no longer be able to:

- Add new money to their wallets or accounts.

- Make credit transactions (including UPI transfers).

- Receive new deposits (except interest, cashbacks, or refunds).

However, you can still:

- Withdraw your existing balance without any restrictions.

- Use existing funds in your wallet or account for payments.

- Continue using your FASTags and NCMC cards (until available balance runs out).

Also Read: How To Pin A Message In WhatsApp Chat: A Step-by-Step Guide

Does This Affect the Paytm App?

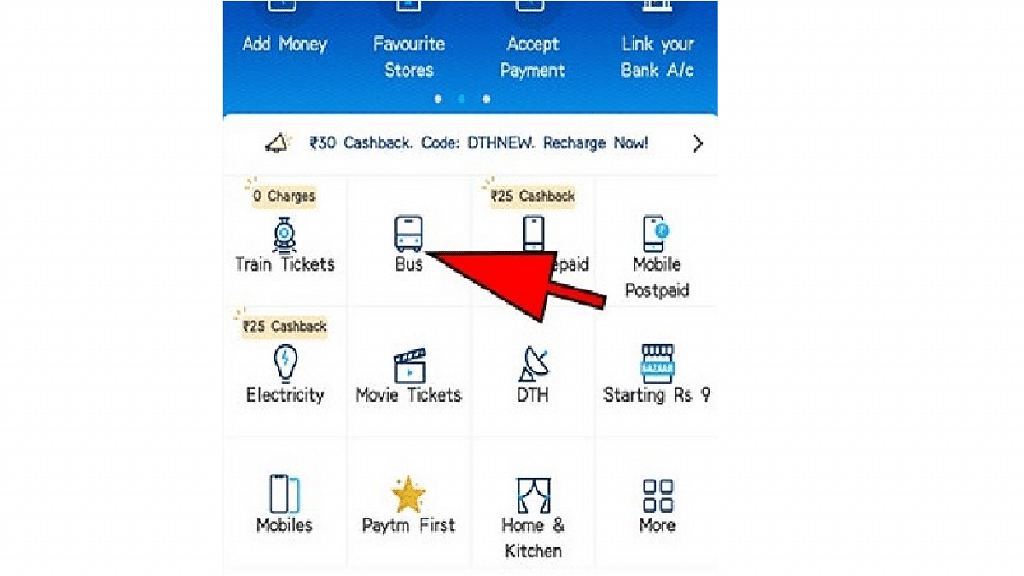

No, not directly. The Paytm app itself is a separate entity and uses other bank partners for its core services. So, you can still use it for:

- Online payments: Shopping online, bill payments, etc.

- Offline payments: QR code payments, soundbox payments, card machine payments.

- Existing wallet balance: Use the money already in your wallet for transactions.

Also Read: Apple CarPlay Not Working? Here’s How to Fix It

What Should You Do?

- Move your money: If you use Paytm Payments Bank, withdraw your funds or transfer them to a different bank account before February 29th.

- Switch UPI: If you use Paytm Payments Bank for UPI, link your account to a different bank for continued UPI transactions.

- Use other payment methods: Explore other wallets or payment methods for future transactions.

Also Read: How to Use Google Circle to Search: Your Step-by-Step Guide

What’s Paytm Doing About the Ban?

Paytm is transitioning its services to other partner banks. This means you won’t be able to use Paytm Payments Bank in the future, but Paytm will continue to offer payment and financial services through different bank partners.

Also Read: Five Key UPI Transaction Changes For 2024

Impact on Paytm’s Business

Paytm expects this ban to have a financial impact of ₹300-500 crore on its annual earnings. However, the company remains optimistic about its future growth through partnerships with other banks.

Overall, while the Paytm app remains unaffected, Paytm Payments Bank users will face limitations after February 29th. Paytm is working on alternative solutions to ensure continued service.