Key Highlights

- According to NPCI, 50% of UPI transactions in India are for Rs 200 or less

- Although UPI payments simplify transactions, there is a daily transaction cap

- Unlimited low-value transactions are permitted every day with UPI Lite

The Reserve Bank of India introduced the UPI Lite in September 2022 to streamline the UPI transaction procedure. A May 2022 NPCI circular states that transactions with a value of Rs 200 or less make up 50% of all UPI transactions nationwide. Unfortunately, even with a small volume of transactions, the UPI system becomes overloaded, which increases the volume of interactions between banks and frequently results in payments getting stuck. UPI requires consumers to add pins and wait for the bank to start payments, which adds to the overall processing time. With UPI Lite users are able to start low-value transactions immediately from a digital wallet using this functionality without having to input their UPI pin.

Also Read: Want To Set Up UPI Lite In BHIM App? Here’s How To Do It

How Does UPI Lite work?

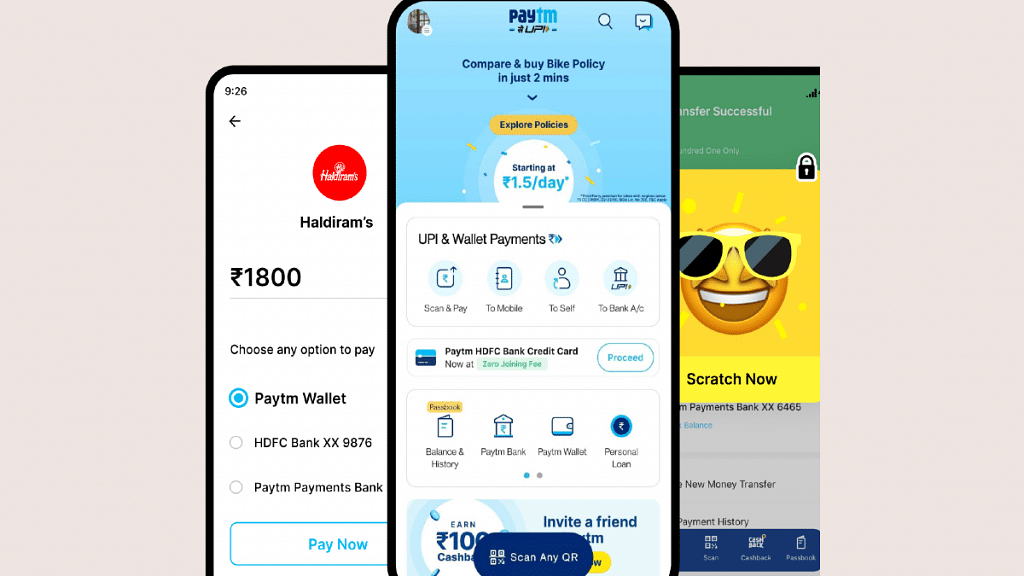

Using UPI Lite is equivalent to using a wallet. Simply enable UPI Lite in one of the apps that is compatible with it and add money (up to Rs 2000) using your UPI account. You can scan any QR code or enter a phone number to pay an amount under Rs 200 without a PIN once the funds have been credited to your wallet.

The main distinction between conventional wallets and UPI Lite wallets is that money will be transmitted directly to the user’s UPI account. This is done to lessen the pressure on the CBS (Central Banking System) of banks during periods of heavy UPI usage, which can be used for high-value transactions.

Also Read: YouTube Tips And Tricks: How To Download YouTube Shorts Videos Offline

Paytm UPI Lite

Users can utilize Paytm UPI Lite to instantly send up to Rs 200 after setting up the service. However, when using this service to make payments, consumers do not need to use UPI PIN or wait for banks to confirm transactions.

Also Read: How To Recharge Metro Smart Card Online: A Step By Step Guide

How To Setup UPI Lite On Paytm?

You may quickly get UPI Lite ready to use by following the steps below.

Step 1: If you don’t already have it, download the Paytm app to your smartphone.

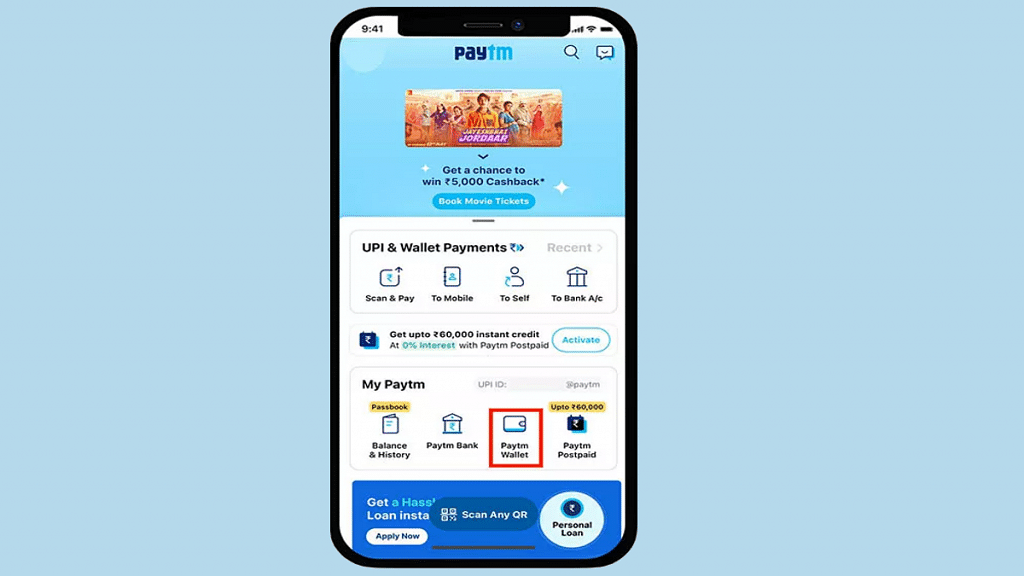

Step 2: Then, hit “Balance and History” after opening it. The UPI Lite option will show up first. Then click “Activate.”

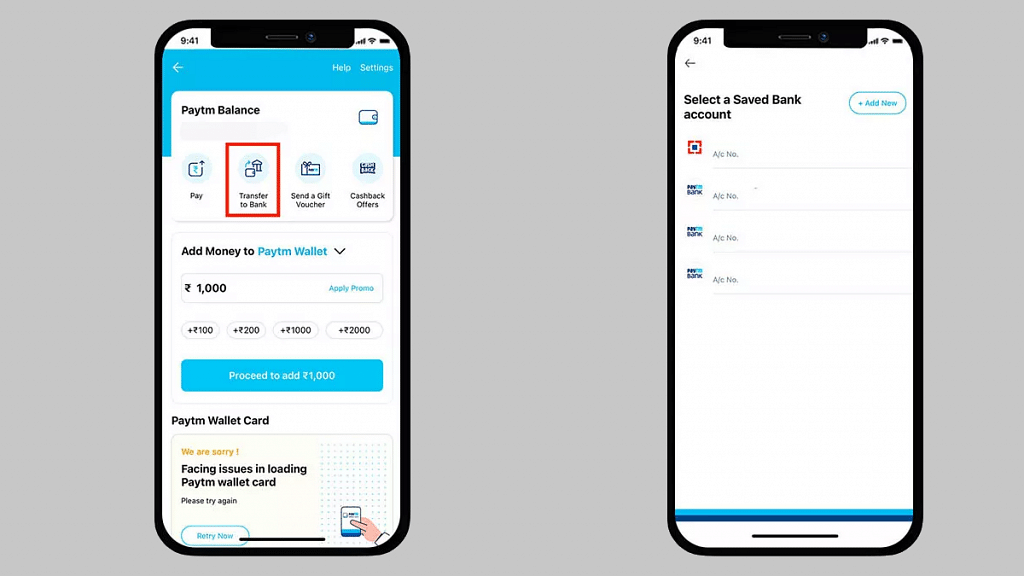

Step 3: If you have a UPI Lite-supported bank added to Paytm, choose it and tap on “Next”.

Step 4: Enter a small amount and click “Add Money to UPI Lite”. Keep in mind that you can only add up to Rs 2,000 and that the money will only be deducted from the supported UPI account. The UPI PIN must now be entered in order to activate UPI Lite.

Step 5: You can now use the UPI Lite wallet to make payments up to Rs. 200 by scanning any QR code without entering your UPI PIN.

Also Read: How To Check Metro Card Balance Offline And Online? Learn Here